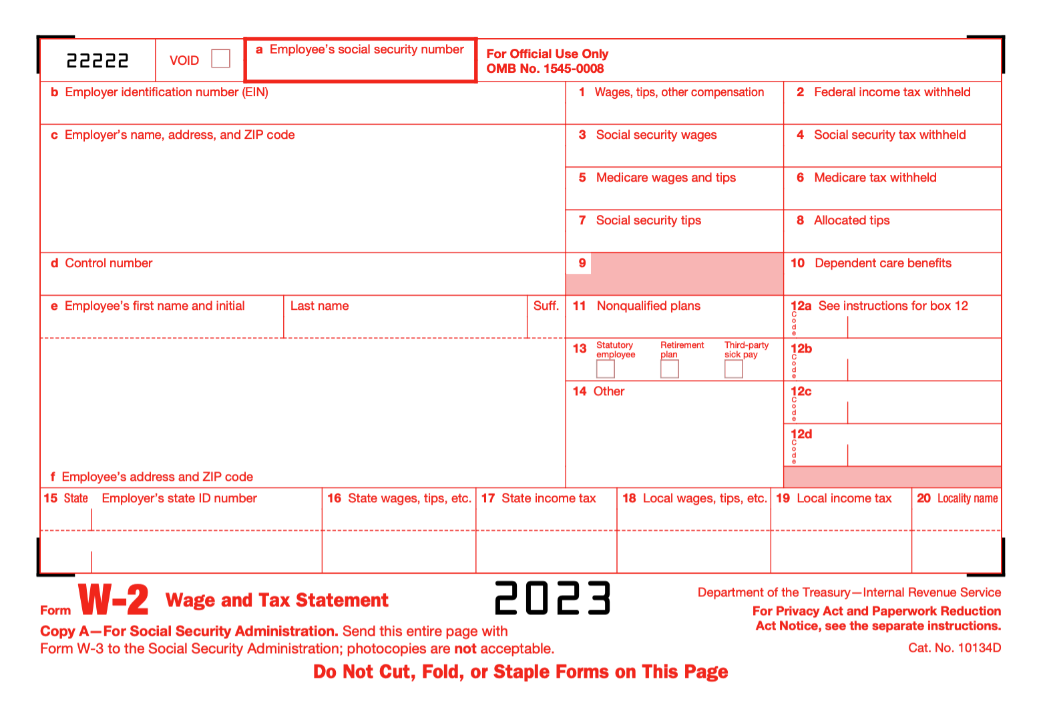

Features of Filing Form W-2 Online

Get best-in-class features when you e-file Form W-2 with ExpressEfile.

Instant Filing Status

Get instant email notifications when the SSA processes your return. You can also check your account to see the status of your W-2 at any time.

Form Validation

Our software runs an internal audit on your Form W-2 so you can catch and correct last-minute mistakes and avoid IRS rejection.

Form W-3

When you e-file Form W-2, we’ll automatically generate your Form W-3. You can keep this summary form for record-keeping purposes.

Mail Employee Copies

We’ll handle mailing W-2 copies to all your employees! Save yourself the time and stay SSA compliant simply this year.

How to File Form W-2 Online?

File your Form W-2 in 3 simple steps as mentioned now. You can E-File the forms easily with our e filing solution.

Enter Form W-2 Information

Collect your required information, select Form W-2, and fill out the form.

Review Form W-2

After our software checks all your information for mistakes and discrepancies, you’ll be prompted to correct any errors.

Transmit the Form W-2 to SSA

Once your form is complete, you can transmit it directly to the SSA. You’ll be notified as soon as your return has been processed.

Deadline to File Form W-2 Online

Form W2 is due on January 31, 2024. Employers need to complete their form, transmit it to the SSA, and provide all their employees with copies by this date.

| Type | Due Date for 2023 Tax Year |

|---|---|

| E-Filing | January 31, 2024 |

| Paper filing | January 31, 2024 |

| Recipient Copy | January 31, 2024 |

Penalties for Not Filing Form W-2 on time

Filing Form W-2 after the deadline results in a $60 file for each form that is late. The penalty will increase to $120 per W-2 30 days after the deadline. After that, penalties can increase up to $310 for small businesses.

Form W-2 E-Filing Pricing

You can e-file Form W-2 for the lowest price if you choose us. Below is the pricing for e-filing Form W-2:

| E-Filing Fee | Mail Employee Copies (Optional) | Form W-3 |

|---|---|---|

| $2.75/form | $1.50/form | FREE |

Meet your deadline easily and enjoy all of our filing benefits for the lowest price in the industry.

E-File Form W-2 NowReady to File Form W-2 Online?

Filing your W-2s should be safe and easy. Simply complete your form. We’ll provide expert support, transmit your return to the SSA, handle all your employee copies, and make your filing process effortless.

Form W-2 vs Form 941

| Form W-2 | Form 941 |

|---|---|

| Form W-2 is a wage tax form that reports wages paid to employees and FICA taxes (social security, income, and Medicare tax) withheld from the employees to the SSA (Social Security Administration). | The IRS Form 941 is an Employer's Quarterly Tax Return. Employers use Tax Form 941 to report federal income tax withheld, social security tax, and Medicare tax (FICA taxes) from each employee's salary to the IRS |

Employers must file Form W-2, if:

|

Employers must file Form 941 to:

|

| The filing deadline to file Form W-2 for the 2023 tax year is January 31, 2024 | The deadline to file 941 Form for 2023 will be the end of the month following the close of the quarter. For Q1 the deadline is on May 01, 2023. For Q2 the deadline is on July 31, 2023. For Q3 the deadline is on October 31, 2023. For Q4 the deadline is on January 31, 2024. |

Helpful Resources on Form W-2?

Understanding Form W-2

Form W-2 is an annual return filed with the Social Security Administration (SSA) by the employers for each employee.

Read MoreWhy should I E-file Form W2?

E-filing has become the preferred option to do tax filings and even suggested by the IRS. Some common advantages why e-filing is opted over paper filing.

Read MoreE-File Form W-2 Now

Frequently Asked Questions on Form W-2?

- How long does it take to retrieve the status of a W-2/1099-MISC filed return?

- How much does it cost to efile & postal mail with us?

- How do I print W-2 and W-3 Forms?

- If I place an order for postal mailing, when will my mailings go out?

- I submitted form W-2s, but it seems there are mistakes on the form. What should I do?

Contact Us

Still have questions regarding Form W2 online filing?

Write us at support@expressefile.com